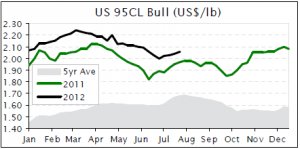

The fall in US domestic prices has come at a time when NZ beef production is seasonally low, so the blow has been softened. In fact, US imported beef prices have actually increased on the back of limited imported supplies, especially from Australia. The demand for US imported beef is still there despite the spike in domestic supplies, since end users require the frozen imported product to bind with their fresh product to produce burger patties. US imported prices are following a similar trend as a year ago but are trading at a premium. Hopefully imported prices continue to track higher to set NZ up for when supplies really come on stream in November/December.

When will Japan ease restrictions on US beef?

Japan currently has age restrictions on US beef, that the beef must come from cattle <21 months of age which was implemented when there was an outbreak of mad cow disease or BSE in late 2003. There has been negotiations for a while now on easing the age restriction from cattle to <31 months of age. This would make NZ beef exports to Japan even more difficult than what they currently are as Japanese analysts believe the amount of US beef entering Japan could increase five fold. It was initially thought that the recent BSE scare in the US at the start of the year would put Japan off until next year, seeing the current restrictions are already BSE related. However, there were reports out of Japan a fortnight ago that it could happen towards the end of this year.

Korea and Japan tough for NZ and Australia

The MLA has had to revise Australian beef exports to Japan and Korea down for the year. Exports to Aussie's largest market Japan are expected to drop 5% in 2012, while exports to Korea, could plummet 28%. NZ is also facing tough times in these major markets. Korean imports of NZ beef for the first 5mths of the year dropped 25%, which was the sharpest fall in imported beef volumes. Japan beef imports from NZ also dropped 12% year on year. Demand is expected to be lackluster for the remainder of 2012 due to a strong AU$ and NZ$, increased competition from the US and increased domestic production in both Japan and Korea.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |